What we are witnessing today seems unreal !

- Lakhs of people across geographies are getting infected

- It’s not restricted to a city, state, region, country, caste, religion, sex or any age-group

- Countries have been locked down

- Economies have come to a near standstill

- International movement of goods and people stand significantly restricted

No one could imagine this and am sure no one knows what lies ahead – at least over the next few months before a potent treatment is announced.

COVID2019 – Scale, Impact and Uncertainty is unprecedented

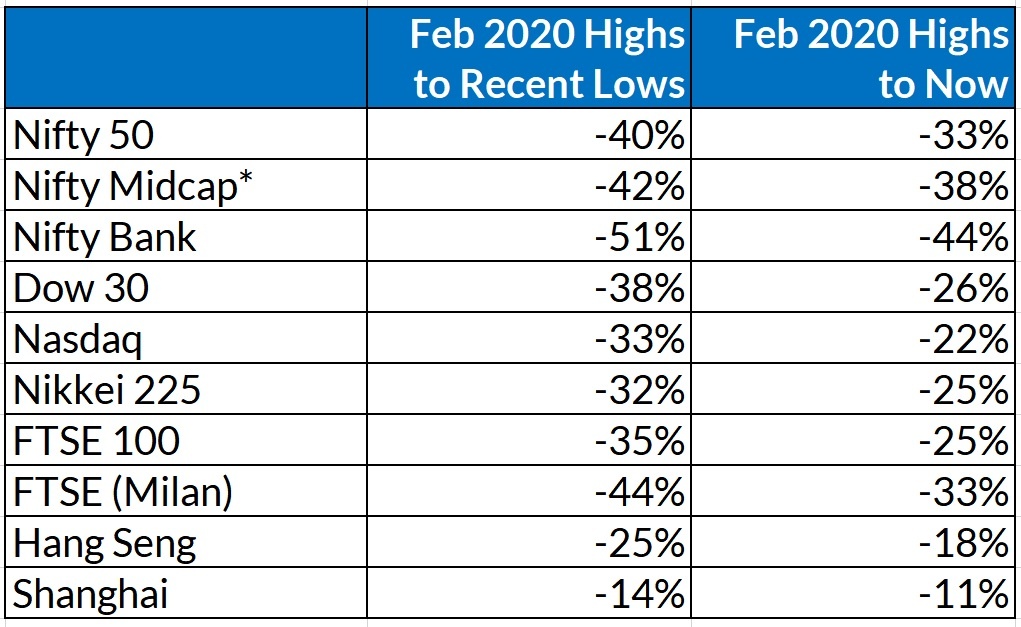

After ignoring the pandemic initially, stock markets worldwide started recognizing the threat by mid Feb 2020 that got accentuated into panic by the first week of March 2020. Reason – what was initially considered majorly localized within China, started spreading into Italy & Iran followed with more and more countries – prompting the governments to announce lock-downs/ restrictions.

Indian stock markets seem to be one of the worst hit. We were already under pressure due to some local issues (especially related to banking) and the COVID2019 uncertainty further prompted FIIs to increase the sell offs.

Most stocks have corrected significantly from the top including Crema De La Creme.

Take this: Bajaj Finance -57%, L&T -53%, ICICI Bank -51%, Reliance -45%, Maruti -45%, HDFC Bank -43%, ITC -43%, Kotak Bank -41%, Infy -37% and so on. The fall is much more steeper in tier-2 stocks.

Though some recovery has happened over last 7-10 days, most stocks continue to trade close to their recent lows.

If you are looking to make some quick bucksGiven the significant price correction, some recent recovery and relative calmness in markets many investors are wondering whether this is a good time to start putting some money to work

Though I know it’s difficult to avoid markets but… STAY AWAY.

Given the uncertainty around the pandemic and related news flow, continue to expect heavy dose of volatility.

If you are going long – news like increasing numbers of infected people, lock-down extensions can suddenly make the markets very nervous.

If you are going short – news like flattening curve, potent treatment, vaccine can suddenly make the markets very excited !

If you are a pure value investorYou know the art of valuations and are therefore best placed to take advantage of the current market conditions.

Though you can find opportunities in every market condition, this is the time that you always wait for.

I am presuming you must be investing heavily nowadays. No point of caution for you as you would have factored in everything.

My only request – please put in comments below how you are factoring in the impact of current economic disruption in your earnings model. That would be of great help to lot of us.

If you are othersUnderlying presumption – World is not coming to an end and this too shall pass !

However, the event, the panic and the actions are unprecedented and how much human and economic disruption it will leave behind… no one knows…

Consequently, the time to recovery is a big question mark. If quickly resolved, it might end up like an extraordinary line item in the Company’s performance reports and if elongated, can set a new world order.

Given this background, please check if key points mentioned below make sense to your investing strategy –

- Panic can make prices fall to unbelievably low levels. However, at the same time no one knows the bottom. So it doesn’t make sense to call, catch or wait for the bottom !

- A staggered accumulative approach is always better under uncertain environments. There is no magic staggered strategy and people mostly follow 20-25% at per-decided price points. However, this is unique to the risk/ return profile of every investor and I know people who go full in at single price points. Personally, under current market conditions, for very strong companies, I am comfortable with half now and half later.

- Identify leaders in the sector that you understand, checkout their response (filings, interviews) during current lock-down situation and guesstimate the impact on their earnings.

- Apply common sense, observe around and checkout the businesses that are getting least impacted and also guesstimate the ones that will start reviving once restrictions are lifted. Do include human fear psychology while arriving at these conclusions – I have never seen this kind of fear before.

- Ignore recommendations from the brokerage houses – they manage large funds and have extensive dealings with businesses in every sector. As an individual investor, there is no compulsion for us to be interested in anything and everything.

- Lesser the debt with the Company – the better. Debt entails fixed costs and during times like these when the operating cash flows are minimal, can create significant pressures on the Promoter and the Company.

I hope that you found the above helpful.

These are very challenging times for everyone. However, I am sure we all will emerge stronger than ever.

Till then… stay home, stay safe and spend quality time with your family – something that we always wished for !