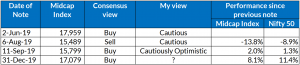

My previous three posts on the topic –

Caution on midcaps has played out reasonably well so far. The midcap index continues to under perform the large cap index.

However, since October 2019, the midcaps are seemingly more stable and are trying to make a come back.

- Most heavily beaten down stocks have stopped falling further and in fact many of these have recovered more than 30% from the lows.

- Stronger stocks (which were consolidating in earlier months) have resumed their upward journey.

As a result, general positiveness has started creeping in and the consensus is again recommending the retail investors to start tilting the portfolio towards midcaps vis-a-vis largecaps. They expect midcap index to outperform the largecap index. Reasons for this belief include –

- Significant under performance of midcap index since early 2018 coupled with attractive current valuations as compared with the largecap index. Current 1 yr fwd P/E of midcaps at 15x is at a significant discount to largecaps (19x). Ideally it should be the other way – midcaps should trade at higher multiples than largecaps.

- Economic revival measures announced by the government since August 2019 (especially corporate tax cuts) and expectations of more to come (personal income tax cuts) in the soon to be announced annual budget on February 1, 2020.

Does that mean one can let go off the guard and start playing on the front foot?Attractive midcap valuations and focus on economic revival is a realty and should definitely start playing out at some point

The above question is not for the stock pickers. They can find opportunities in any market. Even during the last couple of years, when majority of midcaps corrected significantly, few midcaps did generate significant returns for the stock pickers.

The key question instead continues to be… whether midcap index will now have a secular uptrend pushing most of the midcap companies to the historical highs? If this is to be the case, one can then become aggressive and try generating significant returns over short periods by picking out of favor beaten down midcap stocks.

Let’s checkout some key factors –

1. Has the economy started reviving?

Difficult to say. Government has announced varied measures over last 4-5 months but most headline numbers (GDP, unemployment, factory output, energy consumption, auto sales etc) continue to be concerning. This is also despite RBI providing requisite support by cutting the interest rates.

Agreed that many measures take time to have the desired effect and so it might be premature to comment. However, one also needs to factor in the following –

- Most measures announced so far are on the supply side whereas the problem seems to be on the demand side.

- There is an increasing risk of inflation and fiscal deficit playing the spoilsport in the short to medium term. If that were to happen, it may restrict further monetary and fiscal easing to revive the demand.

One good thing – most economists have started calling the doomsday. The history tell you – if majority believes something… that’s never going to happen 😉 So we may actually be starting to look up !

Personally, when I look around… yes, I find caution… people are controlling expenditure… especially on large ticket items… but as such they have not got into any sort of recessionary mood. My last related note – Indian economic slowdown – a reality but recovery may not be far

2. DII and FII flows

We can do as much gyan as required… the fact remains… FIIs continue to call the shots… at least for euphoric/ momentum buying or selling !

Take this – during May to September 2019, FIIs sold > Rs 41,000 cr. Thereafter, from October 2019 to date, they have purchased > Rs 23,000 cr. Now correspond this to the market returns provided in the table above. One starts wondering, whether any other factor really matters to market performance !

What about DIIs? Everyone thought they are getting tons of money (>Rs 8,000 cr per month) and can very effectively counter balance FIIs?

Yes, they are getting funds and are doing best within their limitations. If not for them, the market would have corrected much more when FIIs were selling.

DIIs can not become complacent as they have to manage retail investors’ expectations… that is highly sensitive… and can lead to significant redemption pressures

3. Budget 2020

Lot of expectations are building around this event given the current weak economic environment. Consensus is already factoring in personal income tax rate cuts and various sector specific fiscal boosters.

The event will surely determine market sentiments and direction going forward.

4. Q3 FY 20 results

Current quarter results are anyways expected to be muted. However, the investors would be keenly listening to management commentaries to get cues on the economic revival.

Financial sector’s NPA position, credit growth outlook, consumption growth trends, infrastructure order book/ receivables are some of the key indicators that I would be watching closely.

5. Kashmir, CAA

Both are significant events and in case of any escalations can have significant implications both for the economy and the fund flows.

6. Global factors

International markets continue to be in a secular bull run feeding general investors’ positiveness that in turn had a rub off effect on India. As mentioned before, positive FII flows is one of the key reason for our markets running up since October 2019.

Whether this will continue is anybody’s guess. Investors in general have been expecting significant correction since 2017 but nothing major has happened so far.

The fact remains, India is very unlikely to move in isolation from the global markets.

7. Technical Charts

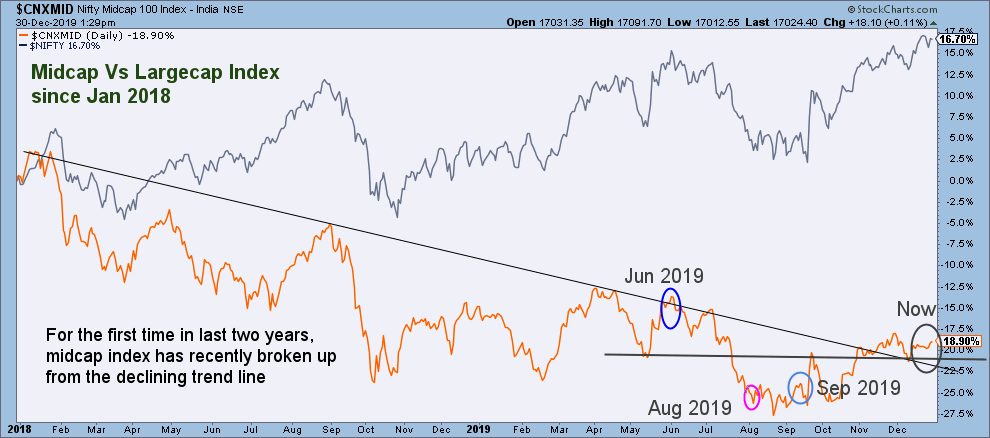

The regular readers would vouch how in all the three previous notes, technical charts have provided a near perfect prediction. Lets checkout them now –

- Short term – midcap index after a long time has broken up from the declining trend line. However, it may be early to call it a change of trend as it has happened very recently (can be false) and only tested it back once. Personally, I would like a longer consolidation and multiple test backs.

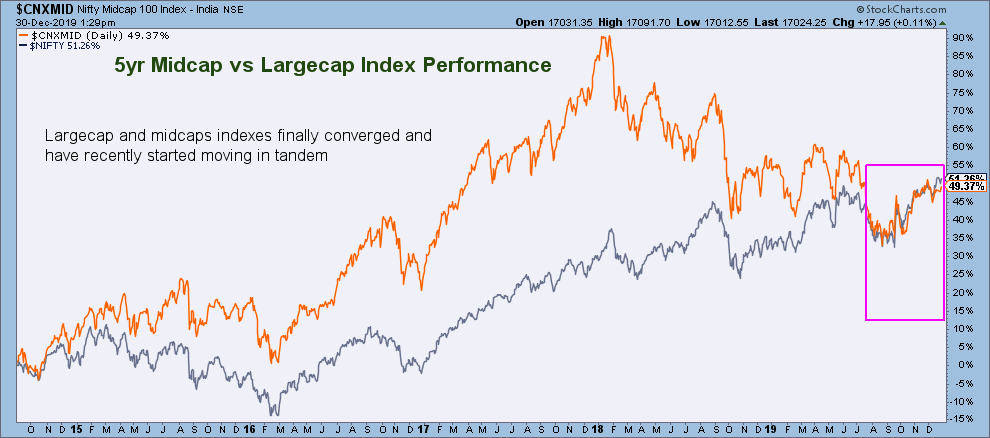

- Medium term – Midcaps and largecaps have finally converged and started moving together

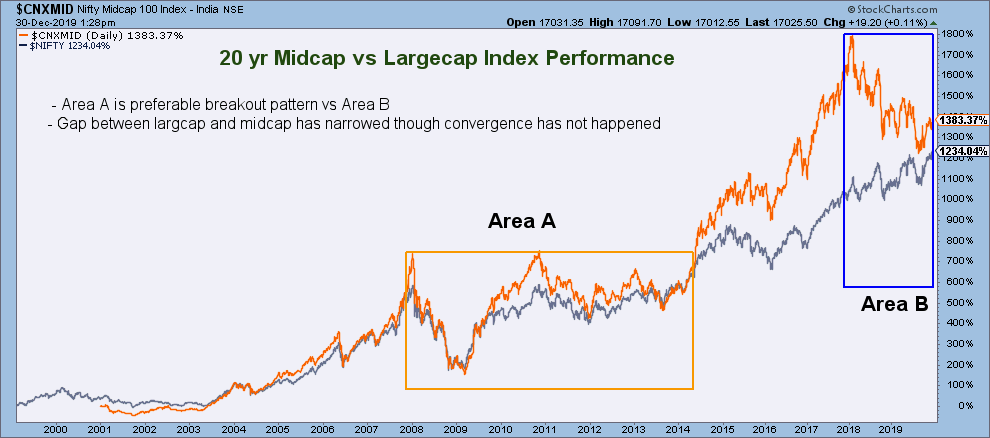

- Long term – Gap has narrowed down significantly though convergence has still not happened. At some point, midcap index is still due for a significant sell off.

Considering everything, I still continue to remain ‘Cautiously Optimistic’. I may decide to selectively venture towards beaten down stocks especially in the auto sector but with tight stop losses.

Key events for me to improvise my startegy include – Budget 2020 and CAA (government’s response). Both can have significant implications for FII fund flows.

Before closing, I hereby wish all my readers a very happy and prosperous new year 2020 !

Disclaimer: Above are my personal opinions and not any recommendation. The reader should do his own research before making any investment.

Need yr support to double my investment to 1000x in coming 30 years. Please advise if you can help me achieve this. Regards